KUALA LUMPUR: An investment cooperative may not be familiar in Malaysia, and Koperasi Amanah Pelaburan Bhd (KAPB) hopes to change that.

Founded two years ago, KAPB executive chairman Datuk Ilyas Mohamed said it could be the first of its kind in Malaysia.

“The goal of a cooperative is to act on behalf of a unified group as a traditional banking service. Usually, a cooperative would attempt to differentiate itself by offering a multitude of services with competitive rates in the areas of insurance, lending and investment dealings.

“An investment cooperative takes it to the next level while also making calculated investments that would, over the medium to long term, benefit its members,” he told Business Times in an interview.

Ilyas said the idea of an investment cooperative may sound alien to the local market, but it is common in more developed markets, such as the United States and Canada, where investment cooperatives mostly invest in properties.

“You must understand that KAPB operates like a public-listed company whose business direction is mainly investing and gaining the best yields and returns.

“In fact, we are an active investor in sectors that we are experts in with long-term value propositions. As of now, we are investing in four main sectors, namely money market, automotive, mining and real estate.”

Much like its counterparts in North America, KAPB mainly invests in the property market.

“The lion’s share of our portfolio is from property investment, which stands at 50 per cent.

“So far, we have only invested in the local property market as we have confidence in it. The way I see it, Malaysia’s property market is still on the competitive side within Asean, barring Singapore. There is much room for growth here in terms of appreciation and returns. Since our direction is to hold over the long term, we are set for profit.”

KAPB has exposure overseas through equity investments in the United Kingdom and Dubai, which have so far been profitable, said Ilyas.

“We are comfortable with investing in these two countries now, plus Malaysia. We are particularly pleased with our UK exposure as we made some gains mainly through the currency exchange.”

KAPB is considering starting an investment vehicle in the form of a real estate investment trust (REIT) later this year.

“We are awaiting approvals from the regulators but I am hopeful that the REIT will materialise this year as we are very upbeat on the local property market.”

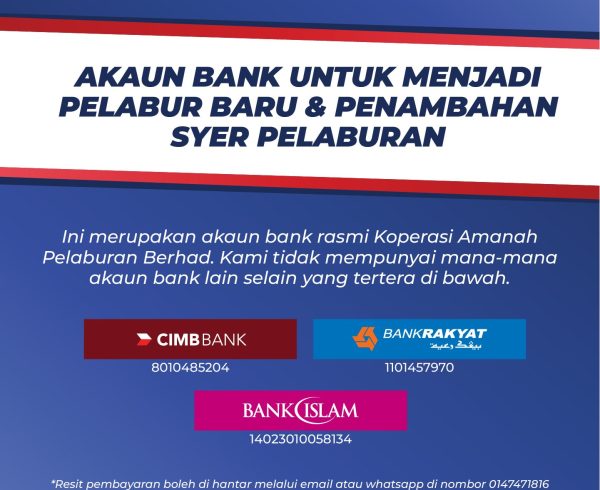

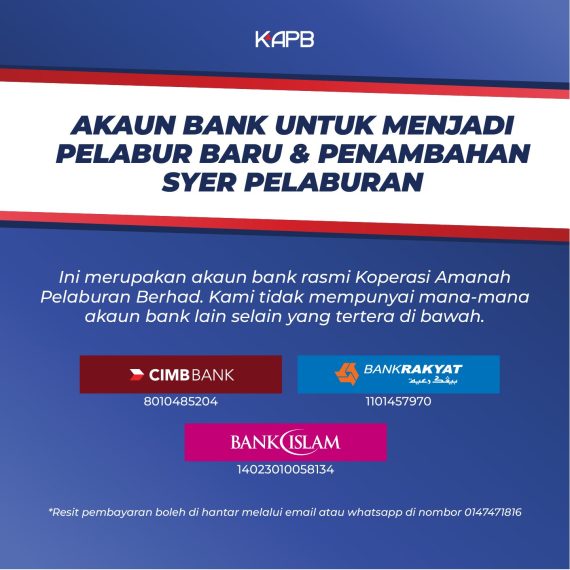

KAPB has some 10,000 members through a smart partnership with 148 Bank Rakyat branches and 16 Rakyat Xcess facilities.

It is managing an estimated RM100 million of funds, and reportedly planned to raise this to RM500 million by year-end.

Ilyas stressed that beyond the partnership, KAPB is not affiliated to Bank Rakyat.

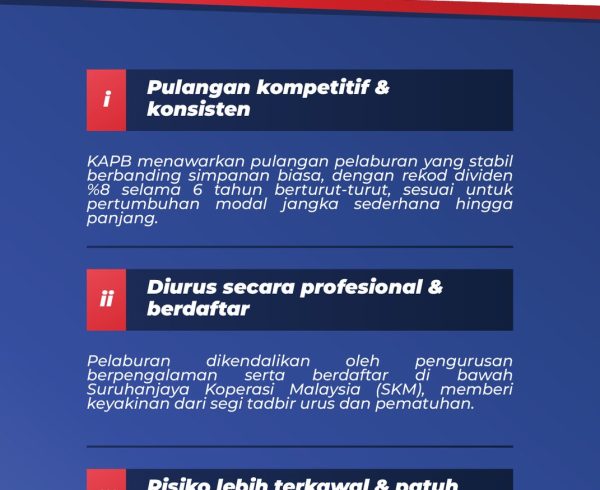

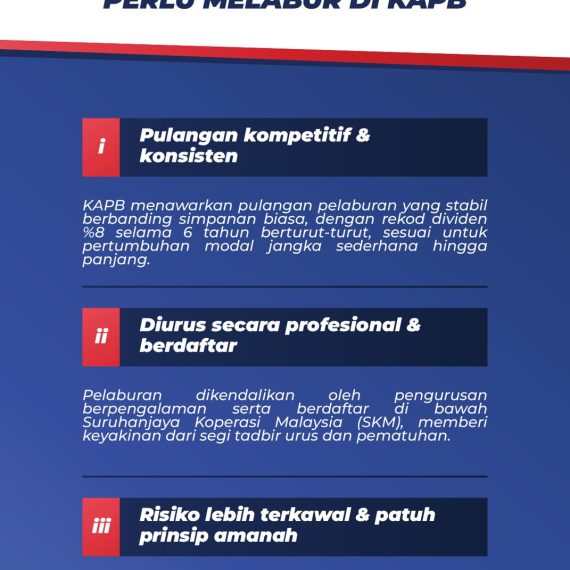

KAPB paid out a 15 per cent dividend to members, which translated to some RM2 million, at the end of its 2015 financial year.

“That was our first time paying dividend and it is the management’s hope that we will be able to pay more than 10 per cent annually.

“Of course I would be pleased if it is more than 15 per cent this year, but we will still be satisfied if we can sustain it at 15 per cent,” Ilyas added.

Source : NST